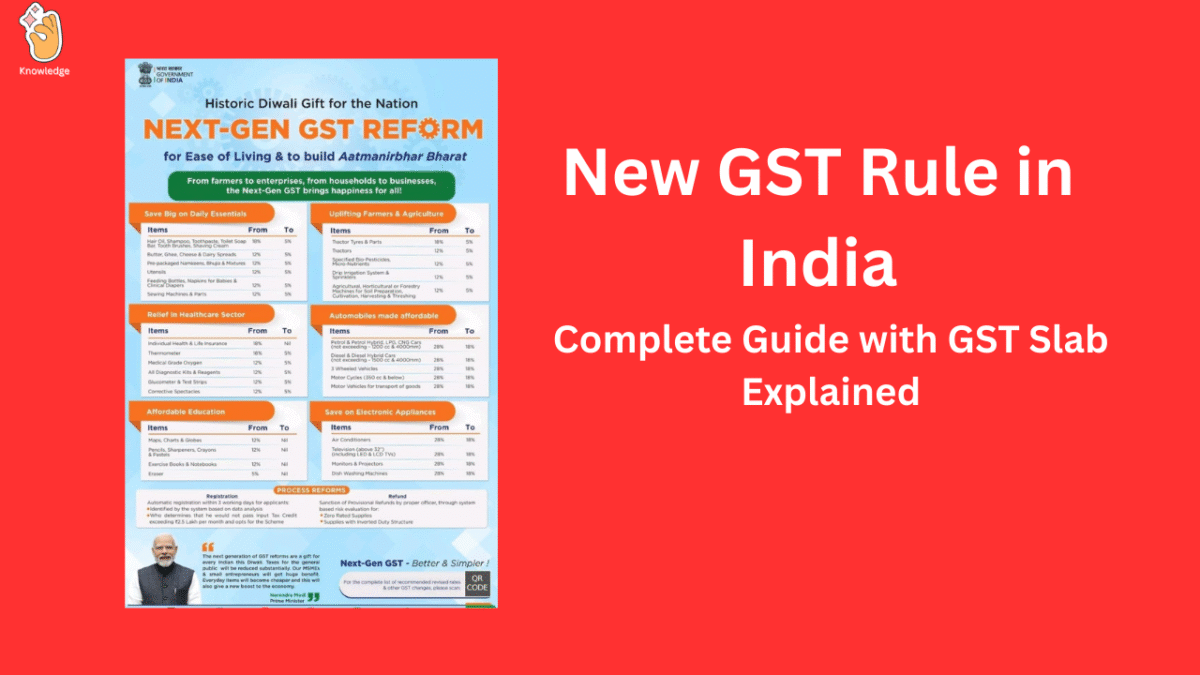

It is one of India’s biggest tax reforms; the Goods and Services Tax (GST). It was introduced in 2017, as a replacement for numerous indirect taxes like VAT, among others, to put in place a unified tax system. India Overhauls GST In 2025, the biggest ever overhaul of GST in India takes place, with a simplified slab structure and new rates for hundreds of items.

This guide to GST slabs and how they work will not just clarify but you will get to know the whole list of new rules and what is cheap, what is expensive and what exactly it means for you.

What Is a GST Slab?

GST slab is a category on which goods and services are taxed. Instead of one slab for all products and services, the GST Council put products and services in various slabs, depending on the nature of the product or service and whether it is a necessity, a standard product or a luxury.

For example:

- Food essentials, such as milk or bread, might be under the 0% or 5% slab.

- Common items such as packaged items or services from a restaurant could come under the 12% or 18% slab.

- Luxury goods like SUVs or cigarettes may attract 28% or higher slabs.

Why Do We Have GST Slabs?

The basis of the slab system is fair tax:

- Necessities remain within the reach of common people.

- Goods of middle-class consumption are moderately taxed.

- Luxury and sin goods (alcohol, tobacco, high-end cars) are heavily taxed as a deterrent to overuse and for generating revenue for the government.

- This gives a progressive tax structure, which balances the contradictions in demand for revenue and affordability.

How Do GST Slabs Work?

- All products or services are classified under an HSN code (Harmonised System of Nomenclature).

- From here, the government determines a tax slab by this code.

Businesses pass that GST on to the government the indirect tax is absorbed by the final consumer; businesses charge it and pass it on to the government.

Example:

When you buy Shampoo bottle of MRP ₹100:

- Old rate: 18% GST → Final price = Rs 118

- New rate: 5% GST → Final price = ₹105

So, when you reduce that by direct slab cutting, you are reducing your direct bill.

The Old GST Structure vs. New GST Structure (2025)

Earlier System (Before September 2025)

- 5% – Essentials & Small Items

- 12% – For Processed food, Household items

- 18% – Most goods and services

- 28% – Luxury and sin goods (+ additional cess for some goods)

New System (From 22 September 2025)

- % Linkage Before 5% (Union) 5% (Merit Rate) – For essentials, food, medicine, personal care, Agri & renewable goods

- 18% (Standard rate) – applicable to most goods and services, small cars, stoves/air-conditioner, cement.

- Rate 40% (Special Rate) – Provided that such rate is applicable for luxury cars, SUVs and sin goods which is tobacco part.

The modification streamlines the system, makes it more transparent and user-friendly.

What Gets Cheaper After GST Reform 2025?

Daily Essentials

- 0% slab: UHT milk, paneer, roti, paratha, life-saving medicines

- 5% slab: Butter o Ghee o Cheese o Dry fruits of Processed foods

Personal Care & Household

- Shampoo, soap, toothpaste, tooth brush, hair oil, talcum powder

- Bicycles, umbrellas, kitchenware, feeding bottles

Healthcare

- 33 life-saving medicines → Tax-free

- All other medicines → 5%

- Medical products (thermometers, bandages, diagnostic kits) → 5%

Services

- Hotels under ₹7,500/night → 5%

- Gyms, beauty parlours, yoga centers → 5 %

- Life & health insurance → 0% (100% tax-free)

Automobiles & Appliances

- Small cars, Motorcycles under 350cc, Ambulances → 18%

- ACs, wash saying machines, TVs, dishwashers → 18%

- Electric vehicles → 5% (same, still cheap)

Housing & Agriculture

-

- Cement → 18% (was 28%)

- Tractor parts, bio-pesticides, fertiliser inputs → 5%

- Renewable energy devices → 5%

What Gets Costlier?

Though the new rules are generally friendly to consumers, several things will become more expensive:

- Garments & footwear over ₹2,500 → 18% (prior 12%)

- Coal → 18% (earlier 5%)

- High-end automobiles, SUVs, luxury cars → 40% slab

- Sin goods (tobacco, pan masala, fizzy drinks) → High slab, status quo or move to 40%

Impact of New GST Rules

- Inflation relief: Economists predict inflation to decline by as much as 1.1%.

- Revenue impact: Government is likely to lose annual tax revenue to the tune of Rs 48,000 crore.

- Demand push: FMCG, auto, insurance and health and hospitality services are likely to do well.

Special Case: Tobacco & Pan Masala

Out of the purview of GST, pan masala containing gutkha, chewing tobacco, un-manufactured tobacco, hookah tobacco or filter khaini were also receiving notifications for providing the concessional rate of tax.

- Presently subjected to GST + Compensation Cess.

- To be moved to 40% slab once cess dues are settled.

- Price will be the retail sale price (RSP), not factory price, to check under reporting.

Key Takeaways

- Now, India adopts a straightforward model of GST with 3 slabs of 5%, 18% and 40%.

- Essential goods and drugs, personal care items and appliances are less expensive.

- Coal, premium clothing and S.U.V.s are more expensive.

- The tax treatment and growth of insurance policies is tax free, which is good for families.

- Amendments in force on 22 September 2025.

Final Thoughts

The GST 2025 reforms signify a consumer-centric approach in lowering taxes on essential and personal goods (requiring only 5-10% of taxes) while retaining high taxes for luxury and harmful products. For the common man, it implies lower monthly spending, while for businesses, it creates opportunities in FMCG, autos and healthcare.

India’s GST is now simpler, fairer and more growth-friendly — a move in the direction of making taxation less complex to understand and easier to comply with.